Motorcycle Road Tax in the UK: Everything You Need to Know in 2025

Whether you’re riding a nimble 125cc commuter or a powerful litre bike, every motorcycle rider in the UK needs to be aware of their road tax obligations. Motorcycle road tax—officially known as Vehicle Excise Duty (VED)—is a legal requirement for most bikes on public roads, and understanding how it’s calculated, how to pay it, and what exemptions exist can save you time, money, and potential fines.

In this guide, we’ll break down the essentials of motorcycle road tax in the UK as of 2025, including how much it costs, how to pay it, and what’s changed over the years.

What Is Motorcycle Road Tax?

Motorcycle road tax, or Vehicle Excise Duty (VED), is a mandatory tax that all vehicles used or kept on public roads in the UK must pay. This includes motorcycles, mopeds, and scooters. The amount you pay is based on the engine size of your bike, and it contributes to maintaining and developing the country’s road network.

Contrary to common belief, VED isn’t used solely for road maintenance, but it remains a crucial revenue stream for the Treasury.

Who Needs to Pay Motorcycle Road Tax?

You must tax your motorcycle if:

- You ride it or keep it on public roads.

- It’s registered in your name with the DVLA.

You don’t need to pay motorcycle road tax if your bike is declared as SORN (Statutory Off Road Notification), meaning it’s kept off the road (e.g., in a garage) and not ridden.

How Is Motorcycle Road Tax Calculated?

For motorcycles, unlike cars, the VED is not based on CO2 emissions but on engine size. As of 2025, the UK Government sets motorcycle road tax bands based on the following engine sizes:

- Under 150cc : £24 per year

- 151cc to 400cc : £59 per year

- 401cc to 600cc : £87 per year

- Over 601cc : £121 per year

You can also choose to pay your tax every 6 months or monthly via direct debit, although paying in full annually is slightly cheaper overall.

Exemptions from Motorcycle Road Tax

Some motorcycles are exempt from paying VED, including:

1. Electric Motorcycles

If your motorcycle is fully electric (i.e., produces zero emissions), you are currently exempt from paying any road tax. However, it must still be taxed annually — at a rate of £0 — and insured.

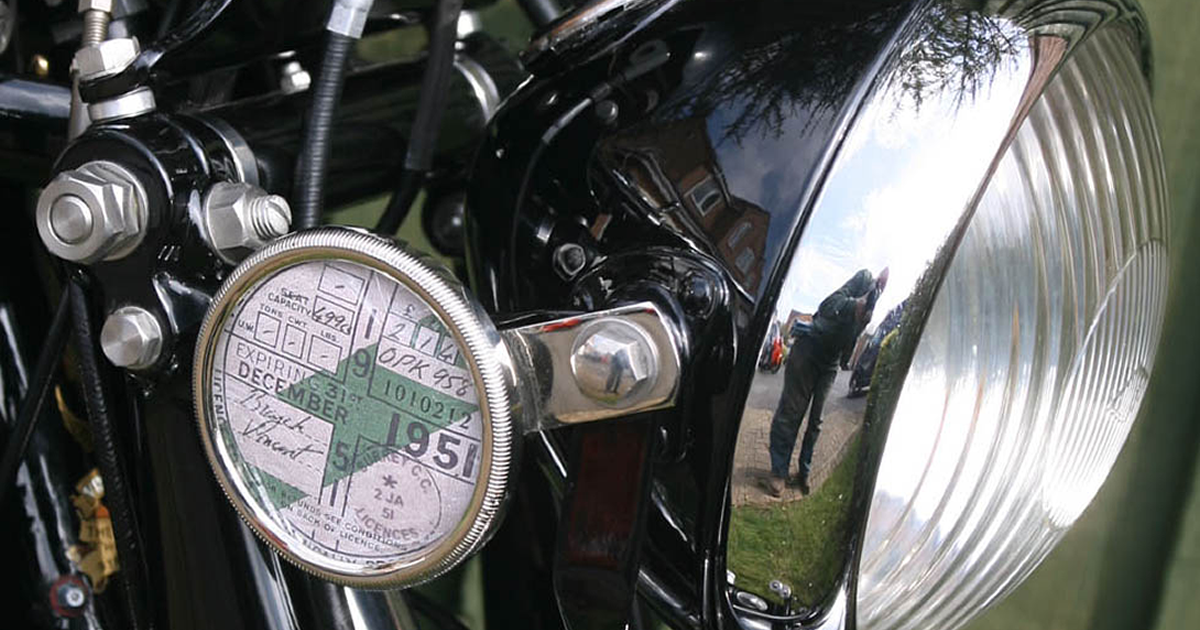

2. Historic Vehicles

Motorcycles that are over 40 years old (and not substantially modified) qualify as historic vehicles. These are exempt from road tax, but like EVs, they must still be registered and display a valid tax disc (or digital record).

3. Disabled Riders

If you receive certain disability benefits, you may be entitled to a discount or exemption on motorcycle tax. This usually applies to riders receiving the Higher Rate Mobility Component of Disability Living Allowance or Enhanced Rate Mobility Component of PIP.

How to Tax Your Motorcycle

Taxing your motorcycle is a simple process and can be done in one of three ways:

1. Online via GOV.UK

Visit www.gov.uk/vehicle-tax and use either:

- Your V11 reminder letter

- Your V5C logbook

- The green ‘new keeper’ slip (V5C/2) if you’ve just bought the bike

2. By Phone

You can call the DVLA vehicle tax service on 0300 123 4321.

3. At the Post Office

Use a Post Office that deals with vehicle tax. Bring along your V5C and proof of insurance/MOT if required.

Note: You must have a valid MOT and insurance policy in place before taxing your bike.

What Happens If You Don’t Pay Motorcycle Road Tax?

Failing to tax your motorcycle can lead to serious penalties:

- Automatic fines: The DVLA uses Automatic Number Plate Recognition (ANPR) cameras to detect untaxed vehicles.

- Penalty notices: You can receive a fine of up to £1,000.

- Clamping or impounding: Your bike can be clamped or towed if caught untaxed on a public road.

- Prosecution: In severe cases, court action may follow.

SORN: If You’re Not Using Your Bike

If you’re storing your motorcycle over winter or not planning to ride it for a while, you can make a Statutory Off Road Notification (SORN). This means you won’t need to pay road tax or insurance while it’s off the road.

To declare SORN, go to www.gov.uk/make-a-sorn. It’s free and takes just a few minutes.

You can only ride the bike again once you’ve taxed it.

Can You Transfer Road Tax When Selling Your Motorcycle?

No. As of 2014, road tax does not transfer when a bike is sold. When you sell your motorcycle:

- The DVLA automatically refunds any full months of remaining tax to the seller.

- The new owner must tax the vehicle in their name before riding it.

This applies even if you’re just transferring it to a family member or friend.

Motorcycle Tax and Insurance

To legally tax your motorcycle, the DVLA checks the Motor Insurance Database to ensure the bike is insured. This is known as Continuous Insurance Enforcement (CIE). If your bike isn’t insured and taxed (or SORN), you could be fined even if you’re not using it.

Can You Ride Without a Tax Disc?

Yes — since October 2014, paper tax discs are no longer issued or required. Everything is recorded digitally, and ANPR cameras enforce compliance. However, you should still keep your documents up to date in case of police stops or when buying/selling the vehicle.

Future Changes to Motorcycle Road Tax?

While current VED for motorcycles is based on engine size, there have been industry discussions about introducing CO2-based taxation, similar to cars. As the UK pushes toward a zero-emissions future, incentives for electric motorcycles are likely to grow, and internal combustion engine bikes may face higher costs or restrictions in urban areas.

It’s worth keeping an eye on government announcements, especially if you’re planning to buy a new motorcycle soon.

Final Thoughts

Motorcycle road tax in the UK is relatively straightforward and quite affordable compared to car tax—especially for smaller or more efficient machines. Whether you’re commuting, touring, or riding purely for pleasure, keeping your bike taxed and legal is essential.

By understanding the current rules, making use of exemptions where possible, and staying on top of your bike’s documentation, you’ll ensure a hassle-free riding experience.

Categories

- Bike Reviews (18)

- General Motorcycling (34)

- Rider Training & Advice (6)

- Roads & Rides (6)

- Why it Matters (5)

Recent Posts

About us

Popular Tags

Related posts

Merry Christmas & Happy New Year from the Team at Mallory Motorcycles!

Yamaha Y-AMT: The Automated Manual Transmission Set to Revolutionise UK Riding

Suzuki GB Launches New Off-Road Experience Centre: 300 Acres of Welsh Trail Riding Awaits

Nationwide Motorcycle Delivery

No corner of the UK is too far for the delivery team and it’s partners at Mallory Motorcycles. We proudly deliver to all major cities, towns, and even remote areas across the entire nation, including:

- London, England

- Birmingham, England

- Leeds, England

- Manchester, England

- Sheffield, England

- Milton Keynes, England

- Salford, England

- Sunderland, England

- Brighton & Hove, England

- Portsmouth, England

- York, England

- Colchester, England

- Chelmsford, England

- Exeter, England

- Gloucester, England

- Winchester, England

- Bradford, England

- Oxford, England

- Ripon, England

- Wells, England

- Liverpool, England

- Bristol, England

- Leicester, England

- Coventry, England

- Wakefield, England

- Nottingham, England

- Newcastle upon Tyne, England

- Doncaster, England

- Wolverhampton, England

- Kingston upon Hull, England

- Plymouth, England

- Derby, England

- Stoke-on-Trent, England

- Southampton, England

- Peterborough, England

- Southend-on-Sea, England

- Canterbury, England

- Preston, England

- Cambridge, England

- St. Albans, England

- Lancaster, England

- Norwich, England

- Chester, England

- Wrexham, England

- Durham, England

- Carlisle, England

- Worcester, England

- Lincoln, England

- Bath, England

- Hereford, England

- Salisbury, England

- Lichfield, England

- Chichester, England

- Newry, England

- Truro, England

- Ely, England

- Belfast, Northern Ireland

- Londonderry, Northern Ireland

- Lisburn, Northern Ireland

- Armagh, Northern Ireland

- Glasgow, Scotland

- Edinburgh, Scotland

- Aberdeen, Scotland

- Dundee, Scotland

- Dunfermline, Scotland

- Inverness, Scotland

- Stirling, Scotland

- Perth, Scotland

- Cardiff, Wales

- Swansea, Wales

- Newport, Wales

- Bangor, Wales

- St. Asaph, Wales

- St. Davids, Wales

Mallory Motorcycles Ltd is registered in England and Wales (Company Registration number 13948787). Registered Address Unit 2 Griffon Road, Derbyshire DE7 4RF. Authorised and Regulated by the Financial Conduct Authority (number 1037062). Mallory Motorcycles Ltd is a credit broker and not a lender. We can introduce you to a limited number of finance lenders and for such introductions we will receive commission. The commission payment can be either a fixed fee or a fixed percentage of the amount you borrow. The lenders we work with could pay commission at different rates. The commission we receive will not affect the amount you repay under the credit agreement. All finance is subject to status. Terms and conditions apply. Applicants must be 18 years or over.